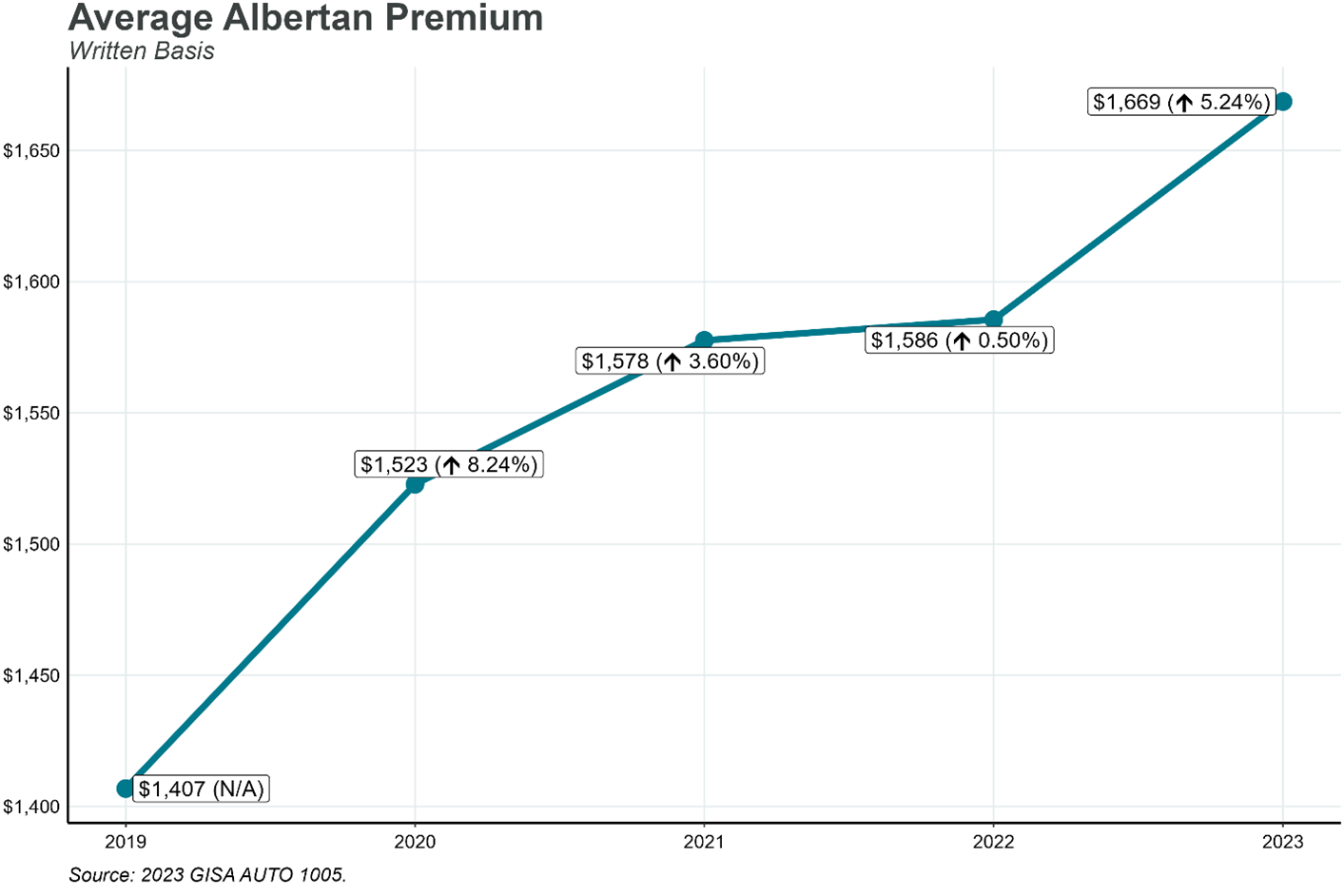

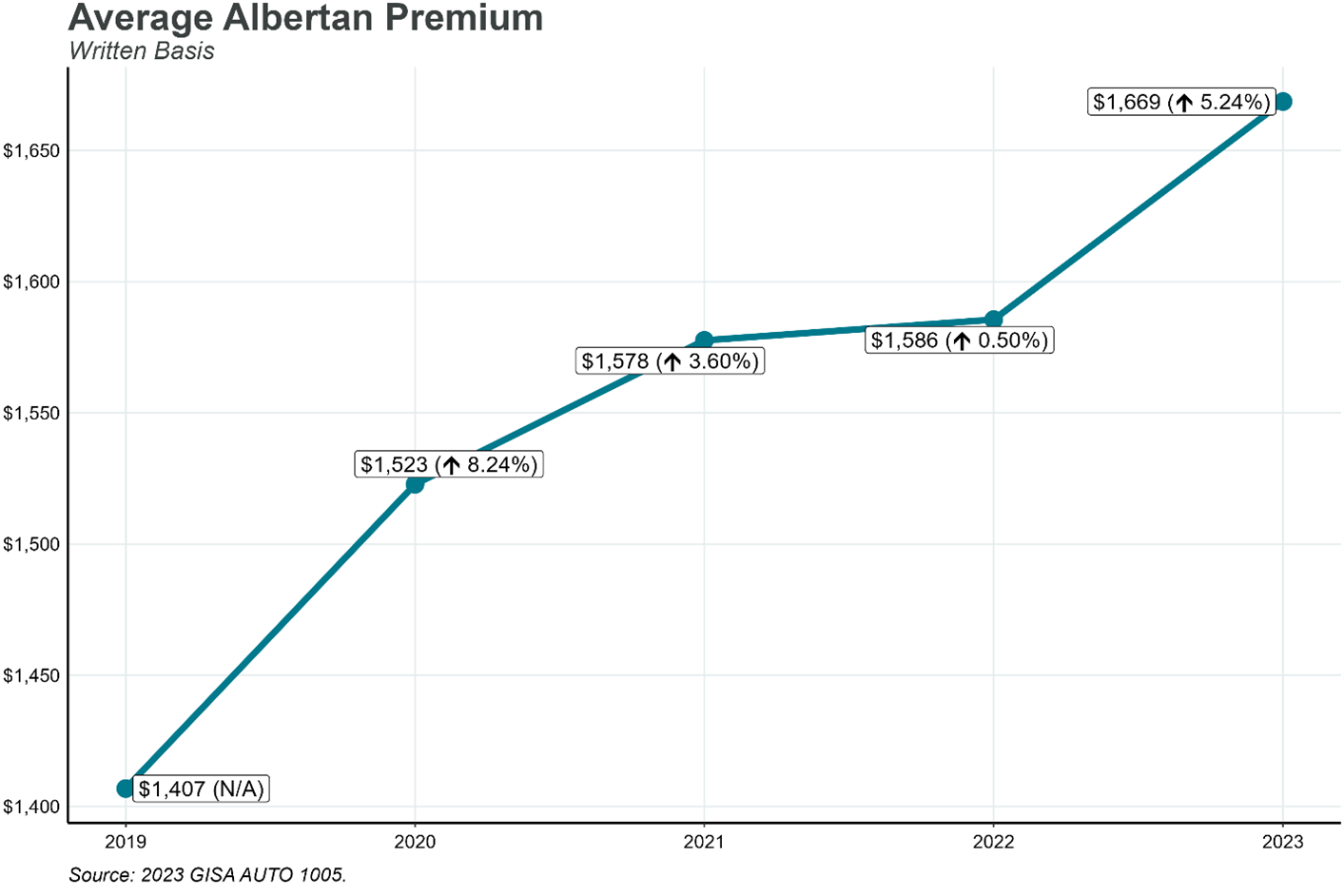

According to recently released data from the General Insurance Statistical Agency (GISA), Albertans paid an average of $1,669 in 2023 for auto insurance, compared to $1,586 in 2022 – a 5.24% increase.

The Automobile Insurance Rate Board (AIRB) was in full compliance with the Ministerial Order that directed the AIRB to pause rate approvals until 2024, however there are several ways your insurer’s approved rating program can impact your premium without filing with the AIRB for a rate increase.

It is important to note there were previously approved rate increases still being implemented in the market. Rate approved in late 2022 were still being implemented during 2023; it takes twelve months for rate to fully flow to all an insurer’s customers.

Premiums may have been impacted during the rate pause if you had a new at-fault claim, a new traffic violation added to your driving record, changed vehicle, added a new driver to your policy, and/or changed your home address. These actions, taken by the policyholder, can have an impact on the premium you pay.

Many drivers have discounts which over time decrease – such as a new business discount which your insurer offered you to attract your business. Over time the amount of this discount reduces on renewal. Another example is a claims or convictions free discount. You may have one traffic ticket and your insurer may not surcharge for one offence but will remove your conviction free discount; this will increase your premiums.

Insurers use driver age as one measure of risk or likelihood of getting in an accident. As we age there are medical conditions which can affect driving performance, and with reduced response time older drivers are riskier from the insurer’s perspective.

Vehicle age also impacts your insurance premium. As a vehicle ages the availability of parts, cost to repair can change. Many insurers use a variable called “vehicle rate group” which considers the likelihood of a car being in an accident and the cost of repairs or value in event it is written off. Recent inflationary pressures have increased the cost of repairing what was once considered a little fender bender will result in a write-off of the vehicle. Not all vehicles depreciate at the same rate, and this can impact the premium calculated as part of the insurers approved rating program.

Lastly, Alberta has experienced population growth in the last few years. There are 3.2% more vehicles insured in 2023 over 2022. The increased traffic can have an impact on collisions and claims. Also, new Albertans from outside Canada are generally rated as “new drivers” and pay higher insurance rates on average because of the lack of Canadian driving experience. This can drive average premiums higher when you look at the province as a whole.

In conclusion, the 5.24% increase in auto insurance premiums for Albertans in 2023 can be attributed to a combination of factors beyond the rate pause. Existing approved rate increases, individual policyholder actions, and changes in personal circumstances such as at-fault claims, traffic violations, and vehicle changes all contribute to fluctuating premiums. Moreover, the gradual reduction of discounts and the insurer’s assessment of driver and vehicle age play significant roles. Understanding these variables can help Albertans better navigate their insurance renewal and anticipate potential changes in their premiums.