Calculate your maximum rate for basic auto insurance coverage by providing details about your driving and insurance history.

The grid rating program was developed to establish the maximum rate insurance companies can charge for basic coverage – third-party liability (bodily injury & property damage tort), accident benefits, and direct compensation property damage (DCPD). Insurance companies must compare a driver’s rate under their current rating program to a driver’s rate calculated by the grid and charge the lesser of the two rates.

Over 90 per cent of Alberta drivers do not pay grid rates. The AIRB’s Grid Rate Calculator will help you calculate your grid rate and explain how the grid rating program works.

The grid applies only to basic auto insurance coverage. This coverage includes third-party liability (bodily injury & property damage tort), accident benefits, and direct compensation property damage (DCPD).

The grid applies only to basic auto insurance coverage. This coverage includes third-party liability (bodily injury & property damage tort), accident benefits, and direct compensation property damage (DCPD).

The AIRB sets the rates (also known as premiums) for third-party liability and accident benefits, and your insurance company sets the rates for DCPD. Your insurance company also determines the rate for additional coverage such as collision, comprehensive, all/specified perils endorsements.

Less than 10 per cent of Alberta drivers are grid rated, comprised mostly of new and less experienced drivers with less than eight years of driving experience.

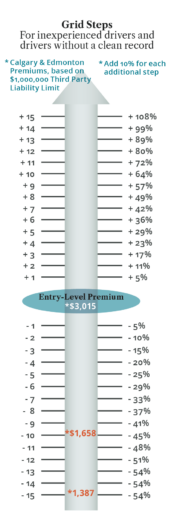

New and less experienced drivers with driver training start at 10 per cent below the base rate, or entry-level premium (Grid step -2). Their rate can also decrease as they gain experience and drive without claims or convictions.

Every year a grid-rated driver goes without an at-fault claim in third-party liability coverage, their rate is reduced five per cent. This can continue until their rate is reduced to a maximum of 60 per cent under the base rate.

Conversely, each at-fault claim increases their rate by five steps. Convictions and at-fault claims result in surcharges on your insurance rate.

The Grid Rate Calculator works best by entering the most accurate information possible. Information entered is not tracked or collected.

Insurance companies will calculate your grid rate based on your driver’s abstract and information from other insurance companies.

In most circumstances, the Automobile Insurance Premiums Regulation requires insurance companies to charge the lesser of the following two rates for basic auto insurance coverage:

Some of the circumstances that allow insurance companies to charge the grid rate rather than a determined possible lower rate are:

If you are concerned about the accuracy of the rates your insurance company charges, contact your agent, broker, or direct writer. If this does not resolve your concerns, you may contact the complaint liaison officer for your insurance company.

Website

Calculate the maximum rate for your basic auto insurance coverage.

Effective May 1, 2024 to December 31, 2024

This document provides Agents and Brokers with general guidance on establishing a driver’s initial grid step.