For Drivers

Find out about the auto insurance needed for transportation network company drivers (Uber, Lyft, etc.).

Transportation Network Companies (TNC) are organizations that provide pre-arranged transportation services using an online-enabled platform to connect passengers with drivers and their personal vehicle. TNCs include companies such as Uber, Lyft, etc.

Drivers for a TNC should be aware that the standard personal auto insurance policy excludes coverage for any vehicle used for carrying passengers for compensation or hire.

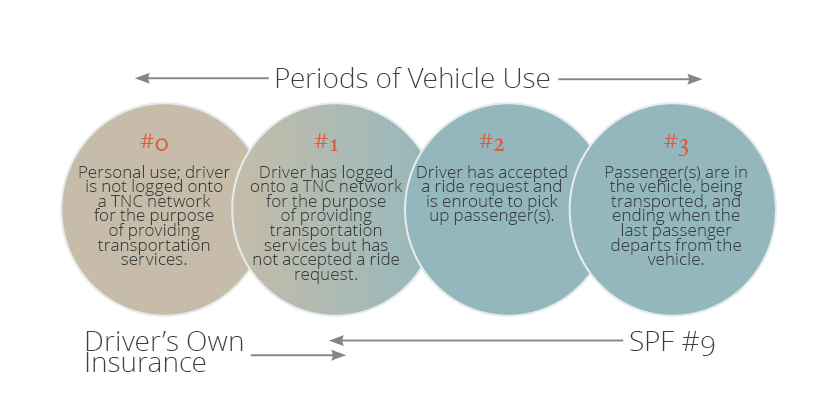

Auto insurance coverage for TNC drivers is based on four periods of vehicle use:

TNC drivers are required to advise their personal auto insurance company if they are driving for a TNC. Some additional coverage beyond the standard policy form may be available through the driver’s personal auto insurance company, or the policy may be cancelled if the insurance company does not cover this type of risk.

More information about auto insurance for TNCs and the SPF #9 is available from the Alberta Superintendent of Insurance’s Bulletin 04-2016.